What is an Invoice?

In simple terms, an invoice is an official document that outlines the details of a sale transaction between a seller and a buyer. It typically includes information such as the name of the goods/services, quantity, unit price, total price, and tax details (if applicable).

An invoice serves as proof of a legitimate transaction, especially when it comes to accounting, auditing, or even business disputes. In Indonesia, we commonly refer to invoices as "faktur."

Functions of an Invoice

An invoice is not just a regular piece of paper or file. Here are several important functions of an invoice:

- Proof of Transaction: An invoice acts as authentic proof that a sale has occurred between two parties – the seller and the buyer. It includes essential information such as the name of the goods or services, quantity, unit price, total price, transaction date, and the identities of the involved parties. In case of disputes or verification needs, the invoice can prove that the transaction indeed took place.

- Payment Reference: The invoice serves as the official reference for the buyer to make a payment to the seller. It indicates the amount to be paid, the payment due date (if applicable), and the payment method or account details. This helps prevent errors in payment amounts or delays in settling the obligation.

- Financial Record-Keeping: In accounting, invoices are essential supporting documents for recording financial transactions. Both the selling and purchasing companies need invoices to track expenses and income accurately. This is crucial for financial reports, business analysis, and strategic decision-making.

- Tax Documentation Invoices, particularly tax invoices, are used as the basis for calculating and reporting tax obligations, such as Value Added Tax (VAT). Sellers are required to issue a tax invoice when delivering taxable goods or services, and buyers can use it to claim input tax credits (if they are VAT-registered). The validity of invoices is crucial during tax audits.

- Official Record in Case of Issues: If any problems arise, such as product returns, service complaints, or financial audits, the invoice can be used as a legitimate supporting document recognized by law. For example, if a buyer claims that the received goods do not match the order, the invoice can be referenced to prove the quantity and type of goods that were agreed upon.

Also Read: Online Payment: Definition, How it Works, and Benefits

Components of an Invoice

To ensure an invoice is legitimate and clear, it typically includes the following key components:

- Company name and logo

- Invoice number

- Invoice issue date

- Buyer’s name and address

- List of goods or services purchased

- Unit price and quantity of goods

- Total price

- Discounts (if applicable)

- VAT or other taxes (if applicable)

- Total payment due

- Payment terms and methods

- Signature or company stamp (optional)

These components can be adjusted based on the type of invoice and business needs.

Types of Invoices

Invoices are not one-size-fits-all; there are several types depending on their usage:

- Regular Invoice: This is the most commonly used type for everyday transactions. It includes the itemized list of goods or services, quantities, and the total price.

- Proforma Invoice: A temporary invoice issued before goods or services are delivered. It is usually used as an offer or payment estimate.

- Tax Invoice: Used for tax recording and reporting, particularly for transactions subject to VAT. This type must be reported to the Tax Directorate (DJP).

- Consignment Invoice: Used in consignment sales, where goods are sold by a third party on behalf of the owner. This type of invoice records the goods entrusted for sale.

- Commercial Invoice: Used in export-import transactions. It contains details such as the goods’ description, price, country of origin, and other customs-required information.

Examples of Invoices

Here’s an example of a standard invoice format:

Purchase Invoice

A purchase invoice, also known as a purchase order, is created by a company when ordering goods from a supplier. It generally includes important information such as order number, order date, the buyer's name and contact, supplier’s details, currency used, and itemized lists of products including name, quantity, unit price, and total price.

- Seller and buyer names and addresses

- Complete addresses of both parties.

- Order number

- Quantity of goods ordered

- Description of items

- Price per unit

- Total price for each item

- Overall amount payable

- Delivery address

- Delivery date

Sales Invoice

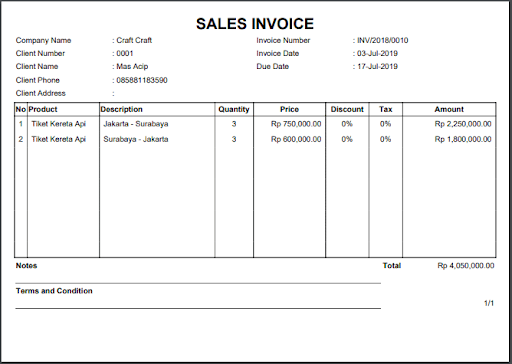

On the other hand, a sales invoice is issued by the seller as proof that the transaction has been completed. This document is very important, as it serves as the basis for tax invoice generation through the e-Faktur system. Here's an example of a simple sales invoice.

Simple Invoice Example

source: www.gramedia.com

Invoice Applications

Nowadays, creating invoices is easier than ever – no need to manually use Excel or Word. Many invoicing apps are available that help generate professional invoices quickly and automatically. These are especially useful for small business owners, freelancers, or anyone working in a company’s financial department. Here are some invoicing apps you might want to try:

1. Jurnal by Mekari

Ideal for small to medium businesses (SMBs), Jurnal not only helps you create invoices but also tracks business finances comprehensively. From profit-and-loss reports to cash flow, it allows easy monitoring. Its simple and user-friendly interface makes it a hassle-free experience.

2. Sleekr Accounting

If you need an app that can also handle bookkeeping, Sleekr Accounting is a great option. Besides generating invoices, it helps manage financial reports, taxes, and regular expenses. It’s equipped with features perfect for those wanting to handle all business finances in one place.

3. Invoice Ninja

This web-based invoicing app is free and great for small businesses or freelancers just starting out. You can create professional invoices, send them directly to clients, and even receive payments online. It’s simple but packed with powerful features.

4. Zoho Invoice

If you deal with international clients, Zoho Invoice supports various currencies and languages. It’s a cloud-based app, so you can access it from anywhere. In addition to invoicing, Zoho offers automation for payment reminders and time tracking.

5. QuickBooks

QuickBooks is a widely used accounting software, particularly among businesses that need an integrated financial system. It generates invoices, manages expenses, payroll, taxes, and financial reports automatically. It’s perfect for businesses looking to streamline their operations as they scale.

Also Read: Sistem Pembayaran: Pengertian, Tujuan, Fungsi, dan Contohnya